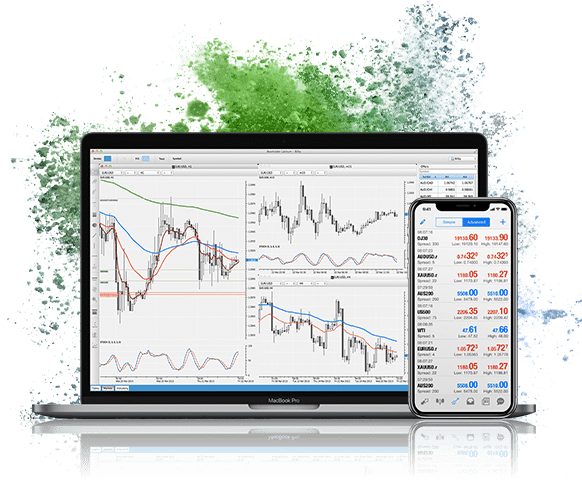

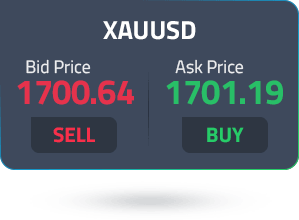

FX Future Trade allows trading the spot price for metals including Gold or Silver against the US Dollar or Australian Dollar as a currency pair on 1:20 leverage for Gold pairs and 1:10 for Silver pairs.

Open a trading account with FX Future Trade, and you will gain exposure to the available global market prices on trading gold CFDs and silver CFDs. Trading metal CFDs with FX Future Trade, a global regulated, multi-award-winning broker.

Auto open & close positions

Auto open & close positions